Table Of Content

On average, they expect the company's stock price to reach $21.47 in the next twelve months. This suggests a possible upside of 50.5% from the stock's current price. View analysts price targets for CCL or view top-rated stocks among Wall Street analysts.

Carnival reports record revenue for its fiscal Q1

However, it has made a roaring comeback fueled by pent-up demand. Bookings have been robust, along with improvements in occupancy. Demand has been so strong that companies are looking to add capacity. Despite the promising outlook, not all travel stocks are well-positioned to benefit. Therefore, investors could look to avoid Norwegian Cruise Line Holdings Ltd. (NCLH), given its poor fundamentals and weak growth prospects.

U.S. Stock Market Quotes

According to 20 analysts, the average rating for CUK stock is "Strong Buy." The 12-month stock price forecast is $21.0, which is an increase of 62.04% from the latest price. Carnival Corp. (CCL) shares turned higher in intraday trading Wednesday after the cruise line posted a smaller adjusted first-quarter loss than analysts expected. According to 20 analysts, the average rating for CCL stock is "Strong Buy." The 12-month stock price forecast is $21.0, which is an increase of 46.75% from the latest price. It is ranked last out of four stocks in the Travel – Cruises industry.

Stocks That Will Be Hit Hardest by the 2024 Baltimore Bridge Disaster

For second-quarter fiscal 2024, it expects adjusted cruise costs excluding fuel per ALBD (in constant currency) to increase approximately 3% year over year. The increase includes an unfavorable impact of 1.3 percentage points attributed to lower ALBDs resulting from the Red Sea rerouting, as certain ships repositioned without guests. The world's largest cruise company's commitment to sustainability and the enchanting beauty of Mahogany Bay in Roatan, Honduras, recognized with top environmental honor MIAMI , April 4, 2024 /PRNewswi... Beyond what we have stated above, we also have given CCL grades for Growth, Value, and Stability. The cruise industry was one of the worst affected by the pandemic.

Carnival Stock Has 54% Upside, According to 1 Wall Street Analyst - The Motley Fool

Carnival Stock Has 54% Upside, According to 1 Wall Street Analyst.

Posted: Mon, 01 Apr 2024 07:00:00 GMT [source]

Zacks Rank & Key Picks

RCL shares were trading at $128.42 per share on Thursday afternoon, up $0.45 (+0.35%). Year-to-date, RCL has declined -0.83%, versus a 5.38% rise in the benchmark S&P 500 index during the same period. Over the past nine months, NCLH’s stock has declined 13.2% to close the last trading session at $18.02. It's easy for investors to become short-sighted and focus too much on financial results from one year or one quarter.

CARNIVAL CORPORATION & PLC REPORTS RECORD FIRST QUARTER REVENUES AND ALL-TIME RECORD BOOKING LEVELS

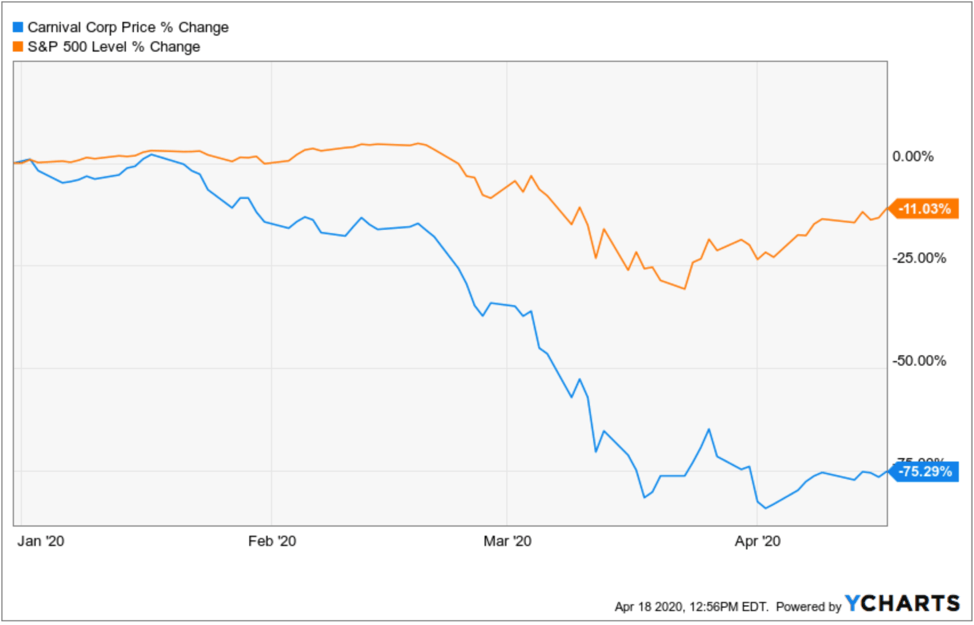

The global cruise market is expected to grow at a 5.1% CAGR, reaching $36.67 billion by 2028. But this is a business that is recovering nicely from the worst days of the pandemic. At one point, Carnival was forced to halt its operations temporarily to prevent the spread of COVID-19. Revenue took a huge hit, dropping 91% between fiscal 2019 and fiscal 2021.

Better Cruise Line Stock: Carnival vs. Royal Caribbean Cruises - The Motley Fool

Better Cruise Line Stock: Carnival vs. Royal Caribbean Cruises.

Posted: Sun, 03 Mar 2024 08:00:00 GMT [source]

A lot of this capital was raised to buy the company time throughout the pandemic. But that's a huge burden that adds tremendous financial risk should there be economic weakness. During that 12-week stretch, the company hit a first-quarter record for sales. Key to this strong momentum is, without a surprise, robust demand from consumers.

More Resources for the Stocks in this Article

On the other hand, waiting for an opportune entry point in Royal Caribbean Cruises Ltd. (RCL) and Carnival Corporation & plc (CCL) could be prudent. For what it's worth, Wall Street believes the good times won't last very long. Analysts see annual revenue gains shrinking going forward, with fiscal 2026 sales rising by just 1.9% compared to the prior year. Carnival Co. &'s stock was trading at $18.54 on January 1st, 2024. Since then, CCL shares have decreased by 23.0% and is now trading at $14.27. Net revenue, prior to the COVID-19 pandemic, peaked out at over $6.5 billion annually.

A 28-year-old man reported missing aboard the Carnival Glory cruise ship on Monday prompted the U.S. Carnival CEO Josh Weinstein joins 'Money Movers' to discuss how the bridge collapse will affect Carnival's operations, security concerns in the Red Sea, and any sign of slowing demand. Royal Caribbean is leading the $61 billion cruise industry's comeback. This comes just a couple of years after a 15-month pandemic era shutdown led to questions about whether the industry could ever r... A Carnival cruise ship rescued 27 Cuban nationals found adrift and signalling for help roughly 20 miles west of Cuba this weekend.

Likewise, the stock’s 1.94% trailing-12-month net income margin is 58.2% lower than the 4.65% industry average. Carnival has been bearing the brunt of high expenses for quite some time. During the fiscal first quarter, operating costs and expenses increased 12% year over year to $3.7 billion. Additionally, higher onboard revenues led to a $43 million increase in onboard and other cost of sales, while repair and maintenance expenses, including dry-dock costs, rose by $30 million. Furthermore, a net unfavorable foreign currency translational impact and increased port expenses each contributed $25 million to the overall rise in expenses. 20 brokers have issued 12-month target prices for Carnival Co. &'s shares.

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2024 and why they should be in your portfolio. New Rank-Based ScoringMarketRank™ is calculated by averaging available category scores (with extra weight given to analysis and valuation), then ranking the company's weighted average against that of other companies. Two cruises have been canceled during the busy spring break season following a fire on the Carnival Freedom, the cruise line announced. In 2023, CUK's revenue was $21.59 billion, an increase of 77.44% compared to the previous year's $12.17 billion.

The company’s goal is to provide extraordinary vacations at an exceptional value. As of 2022, the company laid claim to nearly half of the global cruising market share with several new ships in the works. World's largest cruise company releases annual report detailing its global sustainability performance and progress, including surpassing several sustainability goals well in advance MIAMI , April 10, ... For the fiscal fourth quarter that ended on December 31, 2023, RCL’s total revenues increased by 27.9% year-over-year to $3.33 billion, while its operating income rose considerably to $570 million. The company reported adjusted EBITDA of $1 billion, up 145% over the prior-year quarter.

In the first fiscal quarter, the company announced strong bookings for its NAA and Europe segments, with booking levels notably higher than the previous year’s levels. Despite limited inventory, booking volumes reached unprecedented levels, courtesy of solid demand for future sailings (beyond 2025). The surge in demand led to increased prices and a longer booking window. As a result, the company is attracting more new guests, complemented by a growing base of repeat customers, fostering heightened overall demand and sustainable revenue growth, thereby boosting the bottom line. During the fiscal first quarter, the company reported increased web traffic and successful campaigns in key markets such as Alaska and Europe. In Europe, new marketing initiatives for major brands like AIDA, P&O Cruises and Costa have bolstered brand awareness and contributed to the overall strength of the European portfolio.

Over the past month, the stock has declined marginally to close the last trading session at $127.97. NCLH’s revenues for the fiscal fourth quarter ended December 31, 2023, came in at $1.99 billion. The company’s adjusted net loss and adjusted loss per share narrowed 82.5% and 82.7% to $77.12 million and $0.18, respectively. In addition, as of December 31, 2023, its cash and cash equivalents came in at $402.42 million, compared to $946.99 million as of December 31, 2022. Carnival Corporation & plc is a leisure travel company operating a fleet of cruise ships, hotels, and resorts with international destinations. Brands under the Carnival Corporation umbrella include Carnival Cruise Line, Princess Cruises, Holland America, P&O Cruises, Seaborn, Costa Cruises, AIDA Cruises, and Cunard.

For the fiscal first quarter, which ended on February 29, 2024, CCL’s revenues increased 22% year-over-year to $5.41 billion. The company’s operating income stood at $276 million, compared to an operating loss of $172 million in the year-ago quarter. However, its adjusted net loss and adjusted loss per share narrowed 73.9% and 74.5% over the prior-year quarter to $180 million and $0.14, respectively. In terms of the trailing-12-month gross profit margin, CCL’s 50.52% is 39.6% higher than the 36.18% industry average.

Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart's disclaimer. 23 employees have rated Carnival Co. & Chief Executive Officer Arnold W. Donald on Glassdoor.com. Arnold W. Donald has an approval rating of 93% among the company's employees. This puts Arnold W. Donald in the top 30% of approval ratings compared to other CEOs of publicly-traded companies. The company is scheduled to release its next quarterly earnings announcement on Monday, June 24th 2024.

No comments:

Post a Comment